Abstracts

Abstract

The distinction between redistribution and predistribution is now embraced by many political philosophers, like Jacob Hacker or Martin O’Neill. This distinction, we could think, is particularly important for the question of how we react to crises, like the current coronavirus pandemic. If the policies take the form of taxes and transfers, like cash-flow assistance, it is redistribution, one could argue. If the policies are meant to alter pretax incomes, as policies changing the conditions for bankruptcy are, it is predistribution. This paper shows why that is not so. Re- and predistribution are only techniques of presentation. They are meant to put the emphasis on different ways we can depict the consequences of policies. Both the “pre-” of predistribution and the “re-” of redistribution are misnomers. This paper argues that we cannot establish a strong distinction between policies that are re- and those that are predistributive, as the case of the basic income will show. Given that classical liberals endorsed egalitarian policies, moreover, the idea of predistribution cannot be used by progressives who want to differentiate their social justice platforms from the classical liberal program.

Résumé

La distinction entre redistribution et prédistribution est maintenant acceptée par de nombreux philosophes politiques, comme Jacob Hacker ou Martin O’Neill. Cette distinction, pourrait-on penser, est particulièrement importante pour la question de savoir comment nous réagissons aux crises, comme l’actuelle pandémie de coronavirus. Si les politiques prennent la forme d’impôts et de transferts, il s’agit de redistribution, pourrait-on dire. Si les politiques visent à modifier les revenus avant impôts, comme les politiques modifiant les conditions de la faillite, il s’agit de la prédistribution. Cet article montre pourquoi ce n’est pas le cas. La redistribution et la prédistribution ne sont que des techniques de présentation. Ils visent à mettre l’accent sur différentes manières de décrire les conséquences des politiques publiques. Le « pré » de la prédistribution et le « re » de la redistribution sont tous deux trompeurs. Cet article soutient que nous ne pouvons pas établir une distinction forte entre les politiques redistributives et prédistributives, comme le montre le cas du revenu de base. Étant donné que les libéraux classiques ont approuvé plusieurs politiques égalitaires, de plus, l’idée de prédistribution ne peut pas être utilisée par les progressistes qui veulent différencier leurs plates-formes de justice sociale du programme libéral classique.

Article body

1. THE FALL OF REDISTRIBUTION AND THE RISE OF PREDISTRIBUTION

“Semper pauper eris, si pauper es,” once said the Roman poet Martial—that is, “if you are poor now, then you will stay poor.” One could find a similar adage under the infamous Speenhamland system to mitigate rural poverty in England and Wales, which lasted from 1795 to 1834—“once on the rates, always on the rates.”[1] But what if everyone were on the rates, we could ask, and forever so? This is exactly what a basic income guarantee offers—that is, it offers a periodic payment for everyone without any precondition. Yet the problem, we could think, is that such a redistributive measure disturbs property rights. This is why the idea of “predistribution,” or the “way in which the market distributes its rewards in the first place,” is now often preferred to “redistribution,” which focuses on taxes and transfers. Indeed, said Jacob Hacker,[2] “pre-distribution is where the action is.” Progressive reformers, he added, must embrace this new distributive approach “because excessive reliance on redistribution fosters backlash, making taxes more salient and feeding into the conservative critique that government simply meddles with ‘natural’ market rewards.”[3] Not so. Focusing on predistribution to avoid having to use the tax system is not where the action is. Predistribution is a misleading solution to a fictional problem, this paper argues.

Though the name may be new, the idea of predistribution is anything but. “Inequality,” Henry Simons argued back in the 1930s, “is overwhelmingly a problem of investment in human capacity, that is, in health, education, and skills; it can hardly be scratched by possible redistribution of wealth.”[4] In other words, for one of the founding fathers of the Chicago School of economics, inequality was not a problem that could be solved solely by taxes and transfers. We need to invest in developing the capacities of the people. It is also important to look at market rules and see how they can further equality. “It is an obvious responsibility of the state,” Simons said, “to maintain the kind of legal framework within which competition can function effectively as an agency of control.”[5] Although the concept has now been appropriated by progressives, the idea of predistribution had already been defended by advocates of capitalism. Friedrich Hayek and Milton Friedman both maintained that the background rules of markets should promote economic equality.

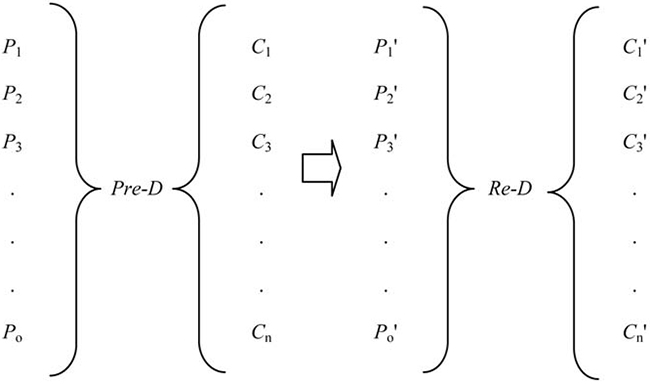

This distinction between re- and predistribution, we could think, is particularly important for the question of how we react to crises—for example, the current coronavirus pandemic or the past financial crises. In such times, unemployment, inequality, and poverty may rise steeply. Should we then enact temporary redistributive policies or rather build predistributive institutions? This is not the right way to think about market distribution, this paper claims. It is not clear that predistribution can be an alternative to redistribution. Every policy has distributive consequences, and different policies will lead to different patterns of distribution in society. The so-called concepts of redistribution and predistribution are actually techniques of presentation, this paper argues. They are meant to simplify the complex connection between policies P and distributive consequences C. They are, moreover, interchangeable, given enough distance or a different point of view. Following the Danish legal theorist Alf Ross,[6] we could argue that it is possible with equal correctness to say

|

(i) |

P has redistributed wealth from one group to another, leading to C, or |

|

(ii) |

the way the market distributes its rewards C is determined by P. |

It is true, at least in economics, that it may be important whether distribution occurs through taxes and transfers or, say, through a reform of employment law. But to judge the justice of our social institutions, or to take the viewpoint of ethics, we should be wary of this now-popular distinction between redistribution and predistribution. Progressives who favour the latter as a way to circumvent the argument of classical liberals like Friedman or Hayek are being overzealous. This is because classical liberal theories, which are also often incorrectly called neoliberal, libertarian, or conservative, embraced both ideas.[7]

For instance, Hayek and Friedman argued for a basic income guarantee—that is, a nonmarket welfare safety net.[8] Hayek, moreover, endorsed inheritance taxation, a limited form of progressive taxation, a reform of the default rules of contract law, a strengthening of workers’ entitlements, and other policies we now associate with liberal egalitarianism.

This paper thus argues for two main points. First, we cannot establish a strong distinction between policies that are redistributive and those that are predistributive, as the case of the basic income will show. These two ideas can be found in every policy. Second, given that classical liberals endorsed the above policies, the idea of predistribution cannot be used by progressives who want to differentiate their social justice platforms from the classical liberal program.

2. THE IDEA OF PREDISTRIBUTION DOES NOT BELONG TO PROGRESSIVES

The idea of predistribution has now been broadly embraced by political philosophers, social theorists, economists, and politicians, like Thomas Scanlon,[9] Joseph Stiglitz,[10] Thomas Piketty,[11] Martin O’Neill, and the former UK Labour leader Ed Miliband. We must be careful how we use this idea, though, especially if it is supposed to distinguish liberal egalitarians from classical liberals. Let us first establish what predistribution cannot be if the idea is to remain coherent. On that point, we can agree with O’Neill to say that “the talk of before and after with regard to the tax system simply does not stand up,” since “economic activity is an endlessly ongoing process.”[12] Predistribution, then, is not an attempt to encourage a more equal distribution “before” governments collect taxes.

Consider how governments use different kinds of relief packages to fight the coronavirus pandemic. If the economic activity of some people is no longer sufficient to afford them a decent livelihood, the government can indeed step in and make sure they at least get enough. If the policies take the form of taxes and transfers, like cash flow assistance, it is redistribution, one could argue. If the policies are meant to alter pretax incomes, as policies changing the conditions for bankruptcy do, it is predistribution. Not so, we will see.

In Norway, for example, if you are a normal employee, your income tax is deducted from your salary before you even receive it. We could think that this tax system is predistributive in the sense that it is integral to the “way in which the market distributes its rewards in the first place,” to use Hacker’s words. But this would only weaken the idea of predistribution. Temporal sequence is not an attractive way to frame the distinction. Could we say that if the tax is taken from you after you receive your salary, it is redistribution, and if it is taken before, then it is predistribution? No. The fact is that taxes, much like other policies with distributive consequences, are ways in which we determine how the market distributes its rewards. There are no before and after moments. We should then reject an understanding of predistribution, Pre-D, as a first moment of distribution as opposed to the second redistribution moment, Re-D, as table 1 illustrates.

Table 1

The Alleged Two Moments of Distribution

O’Neill thinks that the concept of predistribution can nonetheless be an important idea for the progressive agenda, as it can be redeemed in terms of its “aims or effects.” That is, predistribution would pursue (a) more equal bargaining power within the labour market, and (b) greater security, independence, and freedom outside the labour market.[13] This section disagrees. Switching to that definition of predistribution does not make such an idea any stronger. Before James Meade[14] pioneered the idea, classical liberals were already arguing for these two objectives. In fact, Hayek endorsed a basic income guarantee, and Friedman, a negative income tax, following in the footsteps of Frank Knight, Jacob Viner, and Henry Simons, to further these allegedly predistributive aims.[15]

We now face a dilemma. The basic income would be a redistributive policy, according to Hacker, that is justified on predistributive grounds, for O’Neill. Additionally, this basic income would fit right in with the progressive agenda, according to Hacker and O’Neill, though that policy was repeatedly endorsed by classical liberals, libertarians, and neoclassical liberals. Something is manifestly wrong with the concept of predistribution. It cannot both be the “rallying cry” of progressives and describe classical liberal policies.

The difference between classical liberals and liberal egalitarians has been exaggerated. In fact, some progressives have appropriated some ideas of the classical liberal tradition and turned them against that tradition. For instance, Liam Murphy and Thomas Nagel have argued against what they call the error of “everyday libertarianism,”[16] which, as O’Neill writes in agreement, is the view “that fails to take seriously the ways in which the tax system itself is part of the set of legal rules that constitute our overall system of property.”[17] Yet such a view had previously been extensively criticized, for example, by Friedman, Viner, and Knight. Additionally, Hayek had already called out a similar error. “As far as the great field of the law of property and contract are concerned,” Hayek wrote,

we must, as I have already emphasized, above all beware of the error that the formulas “private property” and “freedom of contract” solve our problems. They are not adequate answers because their meaning is ambiguous. Our problems begin when we ask what ought to be the content of property rights, what contracts should be enforceable, and how contracts should be interpreted or, rather, what standard forms of contract should be read into the informal agreements of everyday transactions.[18]

Let us set the record straight concerning the classical liberal understanding of capitalism. A market, classical liberals argued, is nothing else than a given combination of policies, P1, P2, P3, …, Po, and the precise form of market we get is the result of the combination we choose. It is true that not all combinations of policies generate a market—for example, if we have a central direction of labour, other policies will not generate a market. But there is still a very wide range of sets of rules that will generate what we would all recognize as market systems—consider Norway and the United States. There are thus no “natural” market rewards. The rewards are the result of the market we have chosen. A different set of rules will lead to different consequences. There is nothing natural in one not being able to afford the antiviral treatment one needs. This would be the result of the healthcare policies we adopted, and these can be modified.

We know that a market society tends to leave some people behind, such that they may live in extreme poverty, do back breaking manual labour, or find themselves at the mercy of their tyrannical supervisor. Classical liberals accordingly argue that we need some mechanisms to maintain a certain level of equality and sufficiency, in terms of resources, power, or entitlements, without which markets will no longer work in a just manner. For instance, sick people should be able to see a doctor regardless of how rich they are. In fact, “liberalism has always accepted without question,” said Knight, “the doctrine that every member of society has a right to live at some minimum standard, at the expense of society as a whole.”[19] This is because, though there is some indeterminacy about the consequences of markets, it is not the case that in such an economic system everyone will indeed have a decent income. On that point, there is no indeterminacy—we know that some people will be left behind. Since, according to Knight, “the purpose of economic activity is to satisfy wants,”[20] we then need to find ways to compensate for markets when they fail to do so. The tax system, classical liberals understood, is simply a way to make market distribution work in a fairer or more just way, such that no one has to be left behind.

The so-called error of “everyday libertarianism” is not appropriately named. For example, “no modern people,” wrote Viner, another founder of the Chicago School of economics, “will have zeal for the free market unless it operates in a setting of ‘distributive justice’ with which they are tolerably content.”[21] Distributive justice is not something we must take seriously only in times of crisis, when, for example, unemployment or inequality passes a certain threshold. It is rather a built-in feature of markets, classical liberals argued. The tax system is an essential part of market institutions, and therefore that system is also a question of justice. There never was any disagreement between classical liberals and progressives on this issue.[22] Yet if progressives want to appropriate O’Neill’s two aims through the concept of predistribution, then we must indeed disagree.

3. THE ILLUSORY DISTINCTION BETWEEN REDISTRIBUTION AND PREDISTRIBUTION

What we call redistribution and what we call predistribution are simply ways to refer to the distributive consequences of policies. It is not the case that the consequences of predistribution will manifest themselves temporally in a different way for the people than the consequences of redistribution will. The “pre-” of predistribution is a misnomer. If we reform employment law in a way that introduces new costs for employers, like paid sick leaves, the employers will feel the consequences much in the same way as they would a new tax. It is a new cost. This section shows why the distinction between re- and predistribution is an illusion, and then why, as classical liberals were aware, it is the case that making distributive judgments is inevitable in a market society.

Let us now disagree with O’Neill. Not only does predistribution resist definition in terms of temporal sequence, but it also cannot be defined by the two aims he proposed—namely, more equality of bargaining power within the market and more freedom outside the market. First, policies have a diffuse effect on society, and, in fact, every policy will have both re- and predistributive consequences. Second, the effect of one rule depends on the broader system of rules. For instance, certain taxes might have more “predistributive” consequences, like the effects of inheritance taxes on intergenerational wealth accumulation and on inequality of opportunity. But this is so only because we also have a certain system of property rules.

As Cass Sunstein noted, “a grant of entitlements to employees might make employees somewhat wealthier. But market readjustments will ultimately force someone—perhaps workers, perhaps consumers—to bear the resulting cost, and it is quite possible that the adjustment will swallow the redistributive effect, perhaps through changes in the rest of the wage package.”[23] In other words, even if we have strong reasons to think that P1 will lead to C1, it is possible that C1 will be nullified through some market response, C2, C3, …, Cn. The aim of a given policy can be assessed only within the broader set of market institutions. For instance, if we try to strengthen the vacation entitlements of employees, prices may increase, wages may decrease, or hiring may decrease. The incidence of a rule change, therefore, might not be the one we wished for, or at least it might not be entirely. Table 2 summarizes the connection between policies P and distributive consequences C.

Table 2

The Systematic Connection between Policies and Distributive Consequences

In other words, P1 can lead to C1, C2, C3, …, Cn. It is not the case that any policy can lead to any distributive consequence. But there is nonetheless a margin of indeterminacy, such that one P can lead to many C, depending on the circumstances. As Ross noted, we can simplify this kind of table by introducing a semantic reference. That is, we can introduce the notion of distribution D to simplify this systematic connection of P and C.

Table 3

The Simplified Connection between Policies and Distributive Consequences

More precisely, the idea of distribution D, which encompasses both redistribution and predistribution, is a way to simplify the connection of each policy P with some distributive consequences C. That is, following Ross, D merely stands for the fact that P1, P2, P3, …, Po entail the totality of distributive consequences C1, C2, C3, …, Cn. As a technique of presentation, D stands for the policies that “create distribution,” which are shown in one series, and the consequences that “distribution” entails, which are shown in another series.[24] However, the notion that as a result of instituting some policies we “created distribution” is nonsense. Nothing was distributed per se. We rather created an institutional framework.

One conclusion we can draw from this analysis is that all policies have distributive consequences. The expression “distributive policies” is a pleonasm. Again, this idea was well understood by classical liberals. It is impossible not to alter the entitlements of different parties when legislating. This is true whether we regulate, authorize, outlaw, fund, grant, sanction, declare, or restrict. To legislate is to make a distributive judgement.

Another conclusion is that we cannot establish a strong distinction between re- and predistribution because of the indeterminacy of the connection between P and C. The semantic reference D is meaningful only for the broader system of rules—that is, as a result of P1, P2, P3, …, Po. For example, a new liability rule may affect the costs of car liability insurance, which, in turn, may make having a car too costly for poor people and prevent those people from working in some faraway places. Yet this new rule P1 will lead to these consequences only if paired with other rules P2, …, Po. This lesson can be generalized to all rules. Hence, in a market capitalist system, with its intricate system of rules, any policy will have both pre- and redistributive consequences if we use O’Neill’s definition.

Recall that O’Neill thinks that the distinction between re- and predistribution can be explained by the “aims or effects” of policies. On the one hand, if we focus on the effects, we must conclude that the distinction is insubstantial because of the above analysis. On the other hand, if we focus on the aims, we then need to recognize that Hayek and Friedman were progressives much in the way that Rawls and Dworkin were because they argued for the same broad objectives. Since this recognition is unlikely to happen, we should abandon the concept of predistribution. The temporal sequence of policies, their consequences, and their aims are all unsatisfactory ways in which to establish the distinction.

It is easy to get misled by the notions of predistribution and redistribution. There is “market distribution” only in the sense that the combination of policies we choose will lead to a given state of affairs. Laissez-faire is a conceptual impossibility. A market can exist only as the result of institutions like property and contract.[25] Even in times of crises, like the current pandemic, when high unemployment may seem unavoidable, C remains a result of P. Therefore, we can make people and businesses better off with relief packages like a basic income. We can make sure that people get treated if they get sick. This is a matter of policy. Much like progressives, classical liberals share the two aims in terms of which O’Neill wants to define predistribution. But this is not a question of predistribution. It is rather a question of market distribution—that is, of finding the appropriate collection of policies that will broadly and imperfectly lead to the distributive consequences we favour.

It may be that Hacker has not appropriately framed the problem to which predistribution is a supposed to be a response. The problem is not that redistributive measures disturb property rights, one could argue, but that they do not. Instead of changing the institutions that govern ownership and control over the means of production, we leave everything in place and just redistribute some of the resulting income. This is a common Marxist objection, defended by, for example, Iris Marion Young.[26] The issue is not just about shares of income, the argument goes, but also about “relations of production.” Focusing on predistribution, therefore, permits us to change the underlying institutional structure—or what we could name the “base,” as opposed to the “superstructure,” in Marxist terms.

For example, major crises, like the current coronavirus pandemic or the global financial meltdown of 2007–2008, have made some people seriously reconsider the merits of our institutions. If our markets permit the kinds of inequity these crises have created, then perhaps we need to radically rethink our commitment to market capitalism. This is one important thought behind the surge of the concept of predistribution—rather than simply patching our system, we need to reinvent it. Taxes and transfers are often seen as patches, or as a flimsy remedy to an inadequate system. Yet, we must note, any new policy will change the market we have, since a market is nothing but the result of a given combination of rules. Therefore, a new tax can reinvent markets as much as a new regulation of wage-bargaining processes or switching to a single-payer healthcare system. But these are questions of market distribution, this paper argues—not of predistribution.

4. THE EDUCATION OF CYRUS IN DISTRIBUTING COATS AND DEFINING PROPERTY

Let us now examine what the problem with redistribution may be. Since predistribution is supposed to offer an alternative to redistribution, we should be able to show that it does not suffer from the same problem. It is not clear that this can be shown. Consider the case Cyrus the Great had to adjudicate in his boyhood, which Xenophon narrated as follows:

There were two boys, a big boy and a little boy, and the big boy’s coat was small and the small boy’s coat was huge. So the big boy stripped the little boy and gave him his own small coat, while he put on the big one himself. Now in giving judgment I decided that it was better for both parties that each should have the coat that fitted him best. But I never got any further in my sentence, because the master thrashed me here, and said that the verdict would have been excellent if I had been appointed to say what fitted and what did not, but I had been called in to decide to whom the coat belonged, and the point to consider was, who had a right to it.[27]

In this case, the master argued that Cyrus should have simply followed Polemarchus in arguing that “justice is the giving to each man what is proper to him.”[28] The given system of entitlements established that the small boy had ownership of the huge coat, and that the big boy owned the small coat. Hence, we could think, in giving the huge coat to the big boy, Cyrus redistributed and acted wrongly. He bypassed the respective entitlements of the parties to bring about a new allocation of coats. The master, conversely, thought that Cyrus would reflect on the general rules necessary to support peace and order in society.

Table 4

Ownership and the Alleged Second Moment of Redistribution

In other words, the master thought that certain conditioning facts F, like the fact of having lawfully acquired a coat by purchase, led to ownership O. Any redistributive policy P‘, after that moment of ownership, disturbs the entitlements of the parties and is consequently wrong.

But the master was not entirely correct. Cyrus was asked to rule, or make a distributive judgment, which is what he did. That distributive judgment is not posterior to ownership, as it rather defines it. Yet, we could think, Cyrus still made a bad judgement when defining ownership. This is what David Hume once argued—Cyrus incorrectly focused on mere convenience. Hume then introduced his famous analogy of walls and vaults. The happiness of humankind arising from justice, Hume argued, may be compared to a vault, “where each individual stone would, of itself, fall to the ground; nor is the whole fabric supported but by the mutual assistance and combination of its corresponding parts.”[29] One way to understand Hume’s disapproval of Cyrus’s decision, then, is to say that for property rules to be just, they must be inflexible.[30] They can never be broken.

This is the way classical liberal theories are often understood. Redistribution, it is often said, is wrong because it disturbs the entitlements of the parties. Not so, said champions of capitalism, like Hayek and Friedman. It is important to understand the exact mistake Cyrus made because it is the same mistake classical liberals often impute to progressives.

The mistake of Cyrus was to redefine ownership in an inappropriate way. Likewise, when classical liberals criticize progressive policies, more often than not, they argue against an inappropriate method of distribution. In this way, classical liberals will agree with Hume in saying that good intentions are not enough. As Hayek noted, “It may sound noble to say, ‘Damn economics, let us build up a decent world’—but it is, in fact, merely irresponsible.”[31] Cyrus was irresponsible. Therein lies the problem. The fact that Cyrus could make a distributive judgment was never in question—and it could not even be questioned. Inasmuch as one is ruling, one must inevitably make a distributive judgment. The new rule of Cyrus would have been another brick in the wall to define entitlements, not something that could make the vault “fall to the ground,” as Hume put it in his analogy.

According to the predistributive ideology Hacker champions, we could think that the correct solution to the problem here is to look at the way in which the market distributes coats in the first place. But this is an illusion. The problem was not that Cyrus attempted to redistribute coats. The problem was that he was careless in his distributive judgment, given his objective. Predistribution is not a solution to that problem. Cyrus promulgated a policy P1 in order to produce the distributive consequence C1— namely, that the small boy gets the small coat and the big boy, the big one. The problem with this case, classical liberals would argue, is that the same policy P1 can lead to a number of different distributive consequences, C1, C2, C3, …, Cn, including unforeseen and potentially undesirable ones.

5. WHY WE NEED A SAFETY NET IN THE GRAND MARKET MÊLÉE

Re- and predistribution are only techniques of presentation. They are meant to put the emphasis on different ways we can depict the consequences of policies. We can talk of redistribution only in a relative way. For example, given the system of rules, and given the respective talents of people A and B, and given the demand and supply of different talents and goods, then we can say that introducing a specific policy P1 will change the distribution of resources from A to B. But we could have equally said that the way the market distributes its rewards is determined, in part, by P1. This is true whether P1 is a tax or a regulation in employment law. Much like the “pre-” of predistribution, consequently, the “re-” of redistribution is also a misnomer. We can see that the distinction between re- and predistribution is solely a matter of perspective and does no work, analytically speaking. D is only a way to connect P and C.

Taxes are policies like others to determine how consumers will act in a market. If sugar is heavily taxed, but its substitute, sucralose, is not, we can expect the tax to have an effect on the relative consumption of sugar and sucralose. A market with few taxes would be very different from one with many. The Norwegian market is radically different from the American one, not only because of its labour and welfare policies, but also because of its tax system. Taxes are then crucial to determine the way markets distribute their rewards.

The question, therefore, is not whether we use the tax system or the background rules of markets to further egalitarian objectives. Taxes are part of that background. The question is rather whether some policies are justified by their connection to some distributive consequences. Much of what progressives now endorse to counter the consequences of market capitalism was already proposed by classical liberals, including the basic income.

It is easier to understand why classical liberals endorsed a basic income guarantee once we understand what “market distribution” really is. To paraphrase Ross, we often talk as if D were a causal link between P and C, an effect that is occasioned or created by every P, and which, in turn, is the cause of a totality of C.[32] But that is not what happens. Market distribution does not distribute anything per se, I argued. It is rather a shorthand to say that a combination of rules will make market competition possible, as Hayek explained.[33]

In a way, everyone is “on the rates” in a market, regardless of whether we have a basic income. Most of what we get is not a return on labour or capital, but rather a surplus from cooperation.[34] Such cooperation is made possible by the system of rules, and therefore the rewards we get in a market mirror the institutions we choose. That is, C is a result of P—or C is “the rate” people get, given the system of institutions created by P1, P2, P3, …, Po.

The problem is that these institutions are flawed. For example, “two classes of workers,” said Friedman, “are not protected by anyone: workers who have only one possible employer, and workers who have no possible employers.”[35] Similarly, Knight warned us that market institutions systematically disadvantage weak, poor, and improvident people. “But as the game is organized,” Knight wrote,

the weak contestants are thrown into competition with the strong in one grand mêlée…. In fact the situation is worse still; there are handicaps, but, as we have seen, they are distributed to the advantage of the strong rather than the weak.[36]

The situation is even worse—not only are the strong being advantaged by P,[37] but the moment P also defines who the strong will be to get the market rewards C. As talented as one may be, one will not get rewarded for one’s talent if that talent is not currently in demand. Supply and demand, we know, are not only the result of individual preferences, as they are also shaped by our institutions.[38] In fact, our preferences themselves are shaped by our institutions.[39] One may then agree with Knight to say that “it is then justifiable at least to regard as unfortunate the dominance of the business game over life, the virtual identification of social living with it, to the extent that has come to pass in the modern world.”[40] Not only is it unfortunate, but it is also unjust, classical liberals argued.

Having a universal basic income is a way to correct this injustice. Since we do not know exactly how markets can disadvantage specific groups, rather than to make ad hoc policies for each disadvantaged group, it is safer to give a minimum rate to everyone. This “rate,” or basic income, is not in any way shocking for classical liberals or what we now often call conservatives, as Hacker suggested. The problem, said Knight, is that “of improving the game itself, or devising a better one.”[41] Instituting a basic income is a simple way to improve markets, classical liberals argued. A basic income reaches everyone who would not benefit from our institutions, especially when crises disturb their normal functioning.

The timeliness of the basic income is that it permits us to confront the indeterminacy of the connection between P and C. Though we know that in times of crisis, inequality and poverty may rise steeply, we often do not know how the crisis will affect specific people, groups, or enterprises. Even with what we learned from the previous crises, there is still much uncertainty about how to respond to new ones—as evidenced by the disorganized attempts to control the consequences of the current coronavirus pandemic. A basic income, as Karl Widerquist noted,[42] allows people to say “no,” making them less vulnerable to market outcomes. That is, it lessens the uncertainty linked to participating in the grand market mêlée. Both progressives and classical liberals can agree that it is a desirable feature of what we have called “market distribution” that it does not lead to too much uncertainty.

In conclusion, redistribution and predistribution, this paper argued, are untimely ideas in that they put the emphasis in the wrong place and they establish a distinction where there should be none. I previously agreed with O’Neill that “there is simply no such thing as two distinct categories of policy, one marked redistribution and one marked predistribution.”[43] But we cannot agree with him that this distinction can be reframed in terms of the “aims and effects” of policies, such that predistributive policies would then have specific aims dear only to progressives. That distinction creates a false dichotomy.

Appendices

Notes

-

[1]

Karl Polanyi, The Great Transformation, Boston, Beacon Press, 2001, p. 84.

-

[2]

Though the term “predistribution” is often said to have been coined by Jacob S. Hacker in 2011, at the Progressive Governance Conference in Oslo, one can find earlier uses of the term—for example, in James Robertson, “The Future of Money”, Soundings, Vol. 31, 2005, pp. 118–132.

-

[3]

Jacob Hacker, “The Institutional Foundations of Middle-Class Democracy”, Policy Network, 2011, p. 35.

-

[4]

Henry Simons, Economic Policy for a Free Society, Chicago, University of Chicago Press, 1948, pp. 6f.

-

[5]

Henry Simons, Economic Policy for a Free Society, Chicago, University of Chicago Press, 1948, p. 42.

-

[6]

Alf Ross, “Tû-Tû”, Harvard Law Review, Vol. 70, No. 5, 1957, pp. 812–825.

-

[7]

Here, I focus on twentieth-century classical liberals, like Friedrich Hayek, Milton Friedman, Ludwig von Mises, Frank Knight, Jacob Viner, and Henry Simons. The basic principles of classical liberalism are individual freedom, market capitalism, limited government, and the rule of law.

-

[8]

Friedrich Hayek, Law, Legislation and Liberty, London, Routledge, 2013, p. 249. Milton Friedman, Capitalism and Freedom, Chicago, University of Chicago Press, 2002, p. 191.

-

[9]

Thomas M. Scanlon, Why Does Inequality Matter?, Oxford, Oxford University Press, 2018, p. 102.

-

[10]

Joseph Stiglitz, Rewriting the Rules of the American Economy, New York, W. W. Norton, 2015.

-

[11]

Thomas Piketty, “Capital, Predistribution and Redistribution”, in Seminar on Thomas Piketty’s Capital in the Twenty-First Century, edited by Henry Farrell, Crooked Timber, 2014, pp. 90–107.

-

[12]

Martin O’Neill, “Power, Predistribution, and Social Justice”, Philosophy, Vol. 95, No. 1, 2020, p. 70.

-

[13]

Martin O’Neill, “Power, Predistribution, and Social Justice”, Philosophy, Vol. 95, No. 1, 2020, p. 87. The idea of predistribution encompasses, for example, “concerns with minimum wage levels, or the regulation of trade unions and wage bargaining processes, as well as issues of financial and corporate regulation, the regulation of important sectors such as the housing or energy markets, and the use of national and local government procurement spending in shaping the structure of markets” (p. 64).

-

[14]

James E. Meade, Efficiency, Equality and the Ownership of Property, London, George Allen & Unwin, 1969.

-

[15]

Matt Zwolinski, “A Hayekian Case for Free Markets and a Basic Income”, in M. Cholbi and M. Weber (eds.), The Future of Work, Technology, and Basic Income, New York, Routledge, 2019, pp. 7–26.

-

[16]

Liam Murphy and Thomas Nagel, The Myth of Ownership, Oxford, Oxford University Press, 2002, p. 32.

-

[17]

Martin O’Neill, “‘Death and Taxes’: Social Justice and the Politics of Inheritance Tax”, Renewal, Vol. 15, No. 4, 2007, p. 64.

-

[18]

F. Hayek, Individualism and Economic Order, Chicago, University of Chicago Press, 1980, p. 113.

-

[19]

Frank H. Knight, Freedom and Reform, Indianapolis, Liberty Press, 1982, pp. 61f.

-

[20]

Frank H. Knight, “The Ethics of Competition”, Quarterly J. of Economics, Vol. 37, No. 4, 1923, p. 584.

-

[21]

Jacob Viner, “The Intellectual History of Laissez Faire”, J. of Law and Economics, Vol. 3, 1960, p. 68.

-

[22]

Friedrich Hayek, Law, Legislation and Liberty, London, Routledge, 2013, p. xx.

-

[23]

Cass R. Sunstein, “Switching the Default Rule”, N.Y.U. Law Review, Vol. 77, No. 1, 2002, p. 126.

-

[24]

Alf Ross, “Tû-Tû”, Harvard Law Review, Vol. 70, No. 5, 1957, p. 820.

-

[25]

“‘The institution of property,’” said Simons, “is a kind of shorthand notation for an infinitely complicated political-economic system and, indeed, for almost any possible alternative system.… To say that liberal democracy rests on private property is almost pure tautology.” Henry Simons, Economic Policy for a Free Society, Chicago, University of Chicago Press, 1948, p. 27.

-

[26]

Iris Marion Young, Justice and the Politics of Difference, Princeton, Princeton U. Press, 1990, pp. 15ff.

-

[27]

Xenophon, Cyropedia (The Education of Cyrus), I.C3.17, London, J. M. Dent & Sons, 1914, pp. 16f.

-

[28]

Plato, The Republic, I.332, translated by B. Jowett, Chicago, Encyclopaedia Britannica, 1952, p. 298.

-

[29]

David Hume, An Enquiry Concerning the Principles of Morals, Chicago, Open Court, 1912, p. 148.

-

[30]

David Miller, Social Justice, Oxford, Oxford University Press, 1979. p. 165.

-

[31]

Friedrich Hayek, The Road to Serfdom, Chicago, University of Chicago Press, 2007, pp. 215f.

-

[32]

Alf Ross, “Tû-Tû”, Harvard Law Review, Vol. 70, No. 5, 1957, p. 820.

-

[33]

“The functioning of competition not only requires adequate organization of certain institutions like money, markets, and channels of information—some of which can never be adequately provided by private enterprise—but it depends, above all, on the existence of an appropriate legal system, a legal system designed both to preserve competition and to make it operate as beneficially as possible.” Friedrich Hayek, The Road to Serfdom, Chicago, University of Chicago Press, 2007, p. 87.

-

[34]

Peter Dietsch, “Just Returns from Capitalist Production”, manuscript, 2020.

-

[35]

M. Friedman and R. Friedman, Free to Choose, Orlando, Harcourt Brace Jovanovich, 1990, p. 245.

-

[36]

Frank H. Knight, “The Ethics of Competition”, Quarterly J. of Econ., Vol. 37, No. 4, 1923, pp. 609f.

-

[37]

Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations, V.i.II.12, G.ed. p. 715, London, Encyclopaedia Britannica, 1952, p. 311.

-

[38]

S. Deakin, D. Gindis, G. M. Hodgson, K. Huang, and K. Pistor, “Legal Institutionalism: Capitalism and the Constitutive Role of Law”, Journal of Comparative Economics, Vol. 45, 2017, pp. 188–200.

-

[39]

Friedrich Hayek, “The Non Sequitur of the ‘Dependence Effect’”, Southern Economic Journal, Vol. 27, No. 4, 1961, pp. 346–348.

-

[40]

Frank H. Knight, “The Ethics of Competition”, Quarterly J. of Economics, Vol. 37, No. 4, 1923, p. 612.

-

[41]

Frank H. Knight, “Intellectual Confusion on Morals and Economics”, International Journal of Ethics, Vol. 45, No. 2, 1935, p. 219.

-

[42]

Karl Widerquist, Independence, Propertylessness, and Basic Income: A Theory of Freedom as the Power to Say No, New York, Palgrave Macmillan, 2013.

-

[43]

Martin O’Neill, “Power, Predistribution, and Social Justice”, Philosophy, Vol. 95, No. 1, 2020, p. 85.

List of tables

Table 1

The Alleged Two Moments of Distribution

Table 2

The Systematic Connection between Policies and Distributive Consequences

Table 3

The Simplified Connection between Policies and Distributive Consequences

Table 4

Ownership and the Alleged Second Moment of Redistribution